[Paraphr 🔗

Cryptocurrency has gone beyond being just a popular term; it is now an exciting financial realm that has caught the attention of investors worldwide. Many people are drawn to the crypto market because of its potential for significant profits. Although the risks cannot be ignored, the opportunities are equally undeniable. In this article, we will explore various strategies for making money in the world of crypto. We will emphasize the importance of buying at lower prices, selling at higher prices, and provide key tips for effectively navigating this dynamic space.

Invest Smart: The Rule for Making Profits 🔗

Paraphrased text: The key to achieving success in any market, including crypto, is to follow the age-old principle of buying at low prices and selling at high prices. It may sound straightforward, but implementing this strategy effectively necessitates a blend of being aware of the market, timing your actions correctly, and managing risks.

1. Power of Understanding the Market: Knowledge is Key 🔗

If you’re planning to get involved in the world of cryptocurrency, it’s important to gain knowledge about the technology, various projects, and market trends. Make sure you have a good understanding of the factors that can impact cryptocurrency prices, including regulatory changes, technological advancements, and market sentiment. It’s also beneficial to stay updated with the latest news and insights from the financial industry to make well-informed decisions.

2. It’s All About the Right Timing 🔗

Timing plays a crucial role

Crypto markets are extremely unpredictable, and prices can change drastically within a short time. It’s crucial to choose the right moment to enter and exit the market. Remember, patience is key; wait for the right conditions to buy at a lower price and sell at a higher price. Take advantage of technical analysis tools, charts, and market indicators to identify potential opportunities to enter and exit the market.

3. Managing Risk: Safeguarding Your Investment 🔗

Although the possibility of making big profits is appealing, there is also a chance of experiencing substantial losses. It is important to create a risk management plan that involves placing stop-loss orders and determining the amount of capital you are comfortable risking on a single trade. Additionally, diversifying your investments by spreading them across various cryptocurrencies can help mitigate the overall risk.

Crypto Trading Hacks to Boost Your Success 🔗

1. Mix Up Your Investment Strategy 🔗

Don’t bet everything on a single option. Spreading out your investments across different cryptocurrencies is a basic rule of managing risk. By diversifying, you can minimize the negative effect of a poorly performing asset on your overall investment portfolio.

2. Keep Yourself Updated and Don’t Fear Missing Out 🔗

Don’t let the fear of missing out (FOMO) push you into making impulsive choices. It’s important to keep up with market trends, but it’s even more crucial to make decisions based on careful analysis rather than emotional reactions. Making trades solely driven by FOMO can lead to buying at the highest point and selling at the lowest point.

3. Taking the Long View 🔗

Cryptocurrency markets can be extremely volatile in the short run, but numerous prosperous investors credit their profits to adopting a long-term view. It is crucial to take into account the underlying principles of the projects you invest in as well as their potential for future expansion and development.

4. Protect Your Investments 🔗

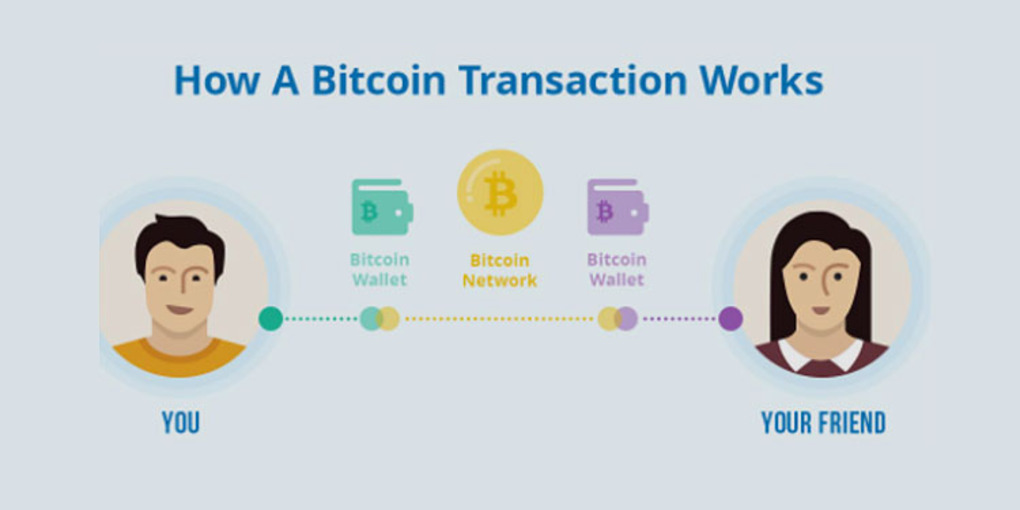

Cryptocurrencies are frequently sought after by hackers. It’s important to use trustworthy wallets and exchanges, activate two-factor authentication, and think about utilizing hardware wallets for secure long-term storage. Taking necessary security precautions is essential in safeguarding your investments.

In summary…

🔗

Earning money in the world of cryptocurrencies requires a mix of smart thinking, managing risks, and having a good grasp of how the market works. The strategy of buying at a low price and selling at a high price remains crucial for successful trading. However, it’s important to continuously learn and adapt to the ever-changing crypto landscape to effectively implement this strategy. By staying informed, being patient, and using sensible risk management techniques, you can enhance your chances of navigating the crypto market successfully and reaping the benefits it offers.